One of the biggest misconceptions for first-time homebuyers is how much you’ll need to save for a down payment. Contrary to popular belief, you don’t always have to put 20% down to buy a house.

A recent survey by Point2Homes mentions that 74% of millennials (ages 25-40) say they’re interested in purchasing a home over the next 12 months. The study notes, “88% say they have significantly less savings than the average national down payment amount, which is $62,600.”

Thankfully, $62,600 is not the amount every buyer needs for a down payment in the United States. There are many different options available, especially for first-time homebuyers (millennial or not). That amount can also be significantly less, depending on the purchase price of the house.

According to the National Association of Realtors (NAR), “The median existing-home price for all housing types in August was $310,600.” (These are the latest numbers available). NAR also indicates that:

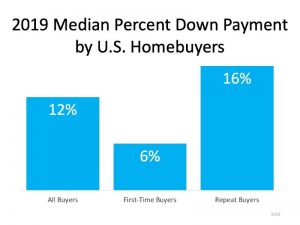

“In 2019, the median down payment was 12 percent for all buyers, six percent for first-time buyers, and 16 percent for repeat buyers.” (See graph below):

That means if a qualified first-time buyer purchases a home at today’s median price, $310,600, with a 6% down payment, in reality, the down payment only amounts to $18,636. That’s nowhere near $62,600.

Knowing there are also programs like FHA where the down payment can be as low as 3.5% of the purchase price for a first-time buyer, that up-front cost could be significantly less – as little as $10,871 for the same home noted above. There are also other programs like USDA and loans for Veterans that waive down payment requirements.

Unfortunately, the lack of knowledge about the homebuying process is keeping many motivated first-time buyers on the sidelines. That’s why it’s important to contact us here at Tabor Mortgage Group to understand the requirements in your local area if you want to buy a home. A trusted agent and one of our loan officers can guide you through the process.

Bottom line, be careful not to let big myths about home buying keep you and your family out of the housing market. Let’s connect to discuss your options today!